The nature and magnitude of the external shocks caused by the global COVID-19 pandemic will also expand to impact the most resilient economies

Worth noting, the nature and magnitude of the external shocks caused by the global COVID-19 pandemic will also expand to impact the most resilient economies, and the current wave of debts may lead to a sequence of financial crises in case of debt mismanagement and lack of well-targeted policy responses not only on the domestic level, but also on the international level. Accordingly, International cooperation and solidarity become more essential than ever, accompanied by sound domestic macroeconomic policies.

Among the outstanding solidarity models of international financial community is the Heavily Indebted Poor Countries (HIPC) Initiative, which was launched in 1996 by the IMF and World Bank. This initiative aims to ensure that that no poor country faces unmanageable debt burden. Hence, the international financial community and governments sought hand-in-hand to promote sustainable levels of the external debt burdens of the most heavily indebted poor countries, providing faster, deeper, and broader debt relief; accommodating debt relief with poverty reduction, and social policies. To-date debt reduction packages under the HIPC Initiative have been approved for 36 countries, 30 of them in Africa, providing 76 Billion USD in debt-service relief over time. On another note, the IMF provides relief on debt services under the Catastrophe Containment and Relief Trust (CCRT). The CCRT enables the IMF to deliver grants to eligible low-income countries member to cover their IMF debt service obligations amid catastrophic natural disasters and during major global public health emergencies.

Relief on debt services provided by the international financial community is considered a fast-acting measure and short-term remedy, which would help to provide factual benefits to vulnerable individuals and households in hardly-hit poor countries, particularly countries that don’t have enough financial resources to cushion the negative socio-economic impact of the COVID-19 and to manage high levels of debts burden. Accordingly, the World Bank Group and IMF, G20 economies and others are allowing the world’s poorest countries to suspend repayment of debt services to safeguard the lives and livelihoods of millions of the most vulnerable people.

Recently, the IMF approved relief on debt service under CCRT for 28 member countries that are poorest and most vulnerable hardly hit during by the current COVID-19 pandemic. This would enable the disbursement of grants for repayment of total debt service falling due to the IMF over the next six months, with potential extensions. Noteworthy, relief on debt service would help to boost financial resources that are much needed to be directed toward vital emergency health needs, instead of debt services repayments and to meet balance of payments needs for containment and recovery. To-date the total debt reliefs for 28 countries are mounted 251.24 million USD.

However, the international solidarity towards providing debt reliefs is not enough to avoid an anticipated string of financial crises ahead. Domestic well-coordinated and swift structural reforms are much needed than ever, to boost the resilience of financial sector and to strengthen fiscal governance; ensuring debt sustainability, which means that government, is capable of servicing its debt at any point in time.

The global COVID-19 pandemic severely impacted both the fiscal space and the financial performance of highly indebted emerging and developing economies, exacerbating debt distress. In spite of heavily debts, these economies could cushion such severity and weather the current global crisis through following; sound debt management and good governance, effective regulation and monitoring of financial sector, and robust monetary, exchange rate, and fiscal policy frameworks. Note worthy, high public debt may limit fiscal space to undertake additional broaden fiscal measures. Accordingly, policymakers in highly indebted countries need to revise and update their debt management strategies and systems, assessing the crisis and financing needs.

Debt management requires adoption of prudential governance principles. These principles include assessment of debt structure, borrowing and repayment policies in terms of their combined effect on potential for insolvency and costs of such crisis. Noting that it is essential to consider that Loan portfolio should balance between welfare gains from each activity with the costs generated by that activity’s contribution to default risk; managing financial institutions and policies to avoidance of financial crisis.

The success of Egypt’s economic and structural reforms provided a unique model for other emerging and developing countries. However, political instabilities and conflicts in the region hindered the reforms in Africa and Arab regions, exacerbating debt distress in the wake of COVID-19 pandemic.

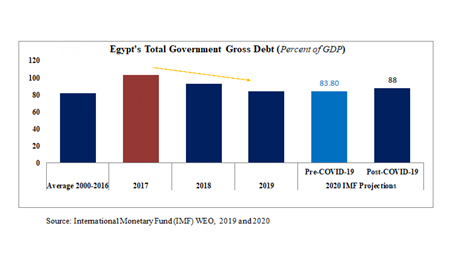

On the back of the economic and structural reforms launched in Egypt, the Egyptian economy becomes more able to weather the negative consequences of the COVID-19 crisis. Noteworthy, the public debt has markedly reduced from nearly 103.2 % of GDP in 2016/17 to around 84 % of GDP in 2018/19. In the mean time the Egyptian government targeted to keep primary surplus of 2 % of GDP and put public debt back on a downward path, reducing further the public debt with projection of slight increase by end of 2020 due to the negative impacts of the COVID-19 crisis. Noteworthy, Egypt is considered to be one of the very limited countries that succeeded in reducing the debt ratio to the GDP during the 2019/2020; this sound achievement was mainly due to the success of economic reform program and the decisive precautionary measures taken to contain the repercussions of the COVID-19.

Whilst, the financial control measures and real growth rates contributed to the continuation of the downward trend in debt rates as a percentage of gross domestic products (GDP).Efforts are continued to reduce risks to debt sustainability through lengthening debt maturities and strengthening revenue mobilization over the medium term to lower gross financing needs and to create an adequate fiscal space for priority spending.

Source: International Monetary Fund (IMF) WEO, 2019 and 2020

Furthermore, well-coordinated structural reforms need to be continued to strengthen good governance and to improve transparency and accountability in public finances and Stated-Owned Enterprises (SOEs) as well as other public entities. In addition, the government keeps monitoring financial vulnerabilities to further safeguard financial stability.

In that context, it is essential to keep maintaining debt sustainability through considering the following main paths in parallel. Promoting sound debt management and debt transparency are critical to ensure that new debt could be repaid at any point in a time, borrowing costs are manageable and well-balanced with gains, and fiscal risks are contained. In addition to bolstering good governance which is crucial to rationalise public spending and fiscal stimulus, ensuring the fiscal stimulus packages are targeted the main needs and purposes through assessing economic response and productivity. Also, putting strict bankruptcy frameworks is needed to prevent debt overhangs from affecting adversely investments over the long-term.

Consolidating the effectiveness of regulations and monitoring of the financial sector would help to give proactive insights of potential risks. Noting that well-strengthened financial sector would effectively contribute to mobilizing domestic savings, which is considered a more stable source of financing.

Well-coordinated and robust monetary, exchange rate, and fiscal policy frameworks contribute to bolstering the resilience of economy amidst the external shocks. The reforms in recent years have provided Egypt with a high-degree of flexibility to weather this shock. Accordingly, the current precautionary measures of monetary easing and fiscal expansion would slightly impact fiscal and debt sustainability. The Egyptian economy recovery gets underway, supported by continued structure reforms and rules of rational fiscal stimulus.

In Conclusion, maintaining debt sustainability is a must, considering the urgency to balance between maintaining sustainable debt levels and the need to meet the sustainable development goals (SDGs) and to boost inclusive growth through increasing investments in infrastructure and human capital, avoiding debt distress through capturing potential risks from contingent liabilities and any further natural disasters.

Last but not least, keep on strengthening the capacity of debt management is a cornerstone for better debt sustainability; bearing in mind the assurance of borrowing in the interest of maintaining sustainable debt levels aligning with sustainable development goals (SDGs).

*The writer holds M.Sc. in Economics,

التعليقات مغلقة.